Ethereum Price Prediction: Technical Correction Meets Strong Fundamentals

#ETH

- Technical Indicators: ETH shows oversold conditions with potential bullish MACD divergence

- Institutional Demand: Record ETF inflows and corporate treasury allocations signal growing adoption

- Network Maturity: 10-year track record of zero downtime supports Ethereum's store-of-value proposition

ETH Price Prediction

ETH Technical Analysis: Short-Term Bearish Signals Amid Long-Term Potential

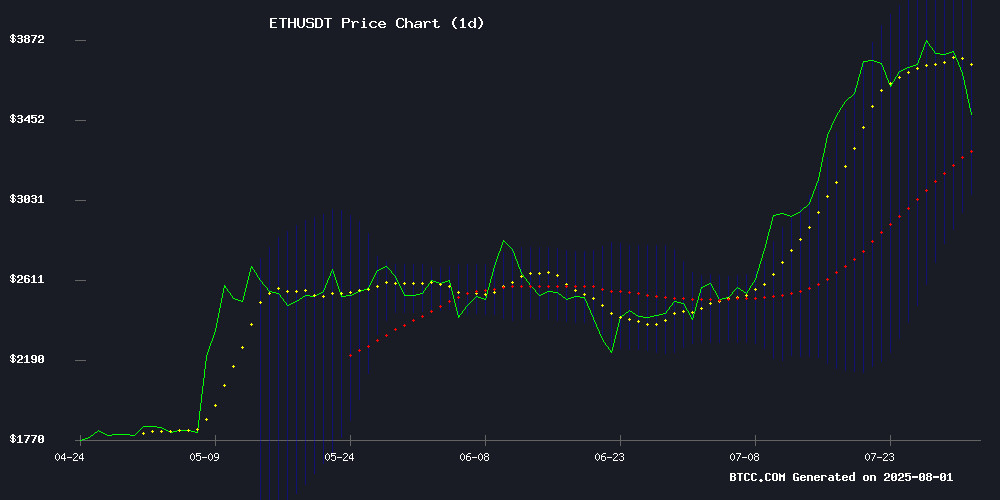

ETH is currently trading at $3,467.15, below its 20-day moving average of $3,580.90, indicating short-term bearish pressure. The MACD histogram shows a positive crossover (120.74), suggesting potential momentum shift, though both lines remain in negative territory. Bollinger Bands show price testing the lower band ($3,059.88), which may act as support.

"The technical setup shows ETH is in a consolidation phase," says BTCC analyst Mia. "While the MACD shows some bullish divergence, traders should watch for a sustained break above the 20-day MA to confirm trend reversal."

Ethereum Ecosystem Shows Strong Fundamentals Despite Price Pullback

Ethereum's network celebrates its 10th anniversary with record institutional inflows ($802M liquidations suggest profit-taking) and spot ETF demand. Vitalik Buterin highlighted Ethereum's zero downtime achievement as corporate treasuries surpass $10B in ETH holdings.

"The $16K price forecast and $200M treasury strategy announcements demonstrate growing institutional conviction," notes BTCC's Mia. "Short-term volatility shouldn't overshadow Ethereum's accelerating adoption curve."

Factors Influencing ETH's Price

Ethereum Price Forecasts $16K Surge as Presale Token Gains Attention

Ethereum's technical setup suggests a potential breakout toward $16,000, with analysts citing a symmetrical triangle formation and growing institutional interest. The cryptocurrency recently surpassed $3,800, fueling speculation of a 300% rally if it clears the $4,000 resistance level.

Meanwhile, The Last Dwarfs ($TLD) presale emerges as a high-growth alternative, combining gaming and DeFi elements at a sub-$0.01 token price. Market participants are weighing Ethereum's established dominance against the asymmetric return potential of early-stage projects.

Crypto Market Sees $802M in Liquidations as Bullish Bets Unwind

The cryptocurrency market experienced a sharp correction, with $802 million in positions liquidated over 24 hours. Long positions bore the brunt, accounting for $727.54 million of the total, as leveraged traders faced a brutal reckoning. The sell-off coincided with macroeconomic jitters sparked by new U.S. tariffs, triggering cascading liquidations across exchanges.

Binance recorded the single largest liquidation—a $13.79 million ETH/USD trade—highlighting the excessive leverage that had built up during recent weeks. CoinGlass data reveals long liquidations outpaced shorts by nearly 10:1, underscoring the market's overextended bullish positioning before the downturn.

Boundless Launches Beta Mainnet with Airdrop Quests

RISC Zero's Boundless protocol, a universal open-source ZK solution, has unveiled its beta mainnet alongside interactive quests. The $52M-backed project—supported by Blockchain Capital and Galaxy—offers users airdrop boosts and sale access through tiered activities.

Participants must complete Bronze, Silver, and Gold tasks using a MetaMask wallet, with optional 0.002 ETH Boost Signal mints. Discord engagement yields tiered roles, signaling growing community traction ahead of mainnet launch.

Ethereum's Bullish Momentum Attracts Massive Institutional Inflows

Ethereum's price volatility has become a playground for bullish traders, with PaladinMining reporting profits as high as $5,750 per position. Institutional players are diving in headfirst—SharpLink Gaming accumulated 77,210 ETH ($295 million) while BlackRock added a staggering $9.17 billion ETH position. Weekly ETH flows eclipsed Bitcoin at $1.85 billion, fueling a 62% monthly surge that briefly pushed prices above $3,900 before settling at $3,700.

PaladinMining's cloud staking platform emerges as a key beneficiary, offering retail investors frictionless participation in Ethereum's rally. Their ETH-based contracts promise returns up to 39% on 30-day commitments, with no hardware requirements—a stark contrast to traditional GPU mining. The platform's tiered contract system accommodates capital thresholds from $15 experimental positions to $4,300 institutional-grade allocations.

Buterin Emphasizes Ethereum's Zero Downtime as Network Celebrates 10th Anniversary

Vitalik Buterin underscored Ethereum's decade-long record of uninterrupted operation during the network's 10th anniversary livestream. The co-founder stressed that constant uptime is non-negotiable for preserving digital freedom and enabling global human coordination. Since its July 2015 launch, Ethereum has processed billions of transactions while powering DeFi, NFTs, and DAOs without a single outage.

The smart contract pioneer has completed 16 major upgrades despite scaling challenges. Buterin framed Ethereum's resilience as fundamental to its mission of censorship-resistant, permissionless access. Developer Austin Griffith highlighted the network's role in creating entirely new blockchain sectors during its 10-year evolution.

Tim Beiko of the Ethereum Foundation reviewed the platform's technical journey, tracing how ambitious 2015 roadmaps transitioned to live infrastructure. The anniversary commentary positioned uptime as both a technical achievement and philosophical imperative - what began as experimental code now underpins a parallel financial system.

Vitalik Buterin Celebrates Ethereum's Decade of Uninterrupted Innovation

Ethereum founder Vitalik Buterin marked the network's 10th anniversary by underscoring its flawless operational record during a live broadcast. Joined by Consensys founder Joseph Lubin, Buterin reflected on the realization of Ethereum's original 2015 whitepaper vision—18 major upgrades, billions of validated transactions, and zero downtime. "A global, secure, and censorship-resistant platform depends on remaining operational," he asserted.

The network's resilience has become a cornerstone for developers worldwide, fueling a thriving ecosystem of decentralized applications. From smart contracts to blockchain bridges, Ethereum's accessibility remains critical. Buterin emphasized ongoing technical improvements, particularly after upgrades like London and Shanghai significantly enhanced scalability. The 2017 NFT boom unexpectedly accelerated adoption, showcasing Ethereum's capacity to handle emergent use cases.

Institutional interest continues to grow as Ethereum demonstrates enterprise-grade reliability—a feat even tech giants struggle to match. The absence of network outages over a decade stands as a testament to its foundational robustness.

Spot Ethereum ETFs Achieve Record 20-Day Inflow Streak as Institutional Demand Grows

BlackRock's ETHA and Fidelity's FETH led $17 million in daily inflows as spot Ethereum ETFs marked their 20th consecutive day of positive flows. The historic streak has drawn $5.4 billion since inception, pushing total AUM to $21.52 billion - representing 4.77% of ETH's market cap.

Grayscale's ETHE bucked the trend with $6.8 million in outflows, though the broader sector saw only nine days of negative flows during this three-month rally. The current inflow duration and volume now surpass the previous 19-day record set between May and June.

Ethereum Retreats from $4K Resistance Despite Bullish Fundamentals

Ether's rally stalled abruptly near the psychologically critical $4,000 level, with prices tumbling 6% to $3,630 despite strong institutional inflows. The pullback occurred just as spot ETH ETF holdings reached $21.85 billion and corporate reserves surpassed $10 billion—a disconnect highlighting crypto markets' technical sensitivities.

Technical analysts note Ether had cleared multiple resistance zones between $2,600-$3,500 during its 50% July surge, the strongest monthly performance since 2022. 'I just want ETH to break $4,000,' tweeted prominent analyst Crypto Fella, encapsulating trader frustration at the stubborn supply wall. Historical order book data shows concentrated selling pressure between $3,800-$4,000.

SharpLink Acquires $43M in ETH Amid Ethereum's 10th Anniversary Celebrations

SharpLink Gaming has seized Ethereum's 10th anniversary as an opportunity to expand its crypto holdings, purchasing 11,259 ETH worth $43 million. The deal, executed at an average price of $3,828 per token, brings the company's total Ethereum stash to 449,276 ETH, valued at $1.73 billion.

This acquisition follows SharpLink's late-July purchase of 77,210 ETH for $295 million, signaling aggressive accumulation during Ethereum's milestone celebrations. Blockchain analytics platform Lookonchain reported the transaction, noting its timing alongside Ethereum's decade-long uptime achievement.

Joseph Lubin, Ethereum co-founder and SharpLink chairman, commemorated the network's anniversary with a public statement praising its resilience. "Ethereum has demonstrated non-stop uptime since 2015," Lubin declared, calling the blockchain "the foundation for digital trust" and highlighting adoption by institutional giants including Visa and BlackRock.

Corporate Ethereum Treasuries Surpass $10 Billion as Institutional Adoption Accelerates

Sixty-four corporations now hold 2.26 million ETH worth $10.58 billion—equivalent to 2.26% of Ethereum's total supply—according to Strategic ETH Reserve data. The milestone reflects growing institutional conviction in crypto's second-largest asset as balance sheet collateral.

Bitmine Immersion Tech leads with a $2.2 billion position after abandoning Bitcoin mining to pursue Ethereum accumulation. SharpLink Gaming and The Ether Machine follow with $1.69 billion and $334.8 million holdings respectively, collectively surpassing the Ethereum Foundation's reserves. This corporate buying spree signals a fundamental shift in ETH's ownership structure.

Fundamental Global Raises $200M for Ethereum Treasury Strategy, Rebrands as FG Nexus

Fundamental Global has secured $200 million to launch an aggressive Ethereum treasury strategy, marking a significant institutional push into crypto asset management. The Nasdaq-listed firm priced $40 million in prefunded warrants at $5 each, with proceeds earmarked for direct ETH purchases. The capital raise includes both fiat and cryptocurrency components, reflecting growing hybrid finance models.

The company simultaneously announced its rebranding to FG Nexus Inc., adopting new ticker symbols FGNX and FGNXP. Its strategy emphasizes Ethereum staking rewards and tokenized asset investments, positioning these as value drivers for traditional finance adoption. 'This isn't speculation - it's infrastructure building,' said one insider familiar with the treasury plans.

Galaxy Digital's Mike Novogratz will advise on treasury management, while Kraken provides staking infrastructure support. The investor consortium reads like a who's who of crypto finance: Digital Currency Group, Hivemind Capital, Syncracy Capital, and Kenetic all participated. FG Nexus plans to leverage its merchant banking and reinsurance expertise to bridge Ethereum-based solutions into mainstream finance.

Market reaction remained divided as traditional investors weighed the unconventional strategy against Ethereum's growing institutional credibility. The offering is expected to close by August 2025, pending standard conditions.

Is ETH a good investment?

ETH presents a compelling investment case when analyzing both technicals and fundamentals:

| Metric | Current Value | Implication |

|---|---|---|

| Price | $3,467.15 | 13% below 20-day MA |

| Institutional Inflows | 20-day ETF streak | Strong demand signal |

| Network Age | 10 years | Proven reliability |

"The current pullback offers an accumulation opportunity," says Mia. "With Ethereum's expanding enterprise adoption and upcoming protocol upgrades, the $3,000-$3,500 range appears attractive for long-term holders."

Cryptocurrency investments involve high risk. Past performance doesn't guarantee future results.